History of the Developer

MMI is a real estate development firm specializing in multifamily focused on producing solid investor returns while making a positive impact where they invest. MMI has developed thousands of units and other projects throughout Orlando, Tampa, Miami, Denver and Austin.

MMI’s strategy is to identify and acquire various existing commercial real estate properties based on sound criteria and fundamentals that other developers tend to avoid. MMI then convert these properties into successful investments that pay above average returns over the entire holding period. MMI also acquires land that can be rezoned and repositioned within Florida’s comprehensive land use plan to create extraordinary values for our investors and partners. MMI draws on a vast array of resources to convert problems into profitable opportunities. Michael Wright, MMI Development founder, has over two and half decades of experience handling billions of dollars in commercial real estate financing, commercial space and land leasing, and development transactions.

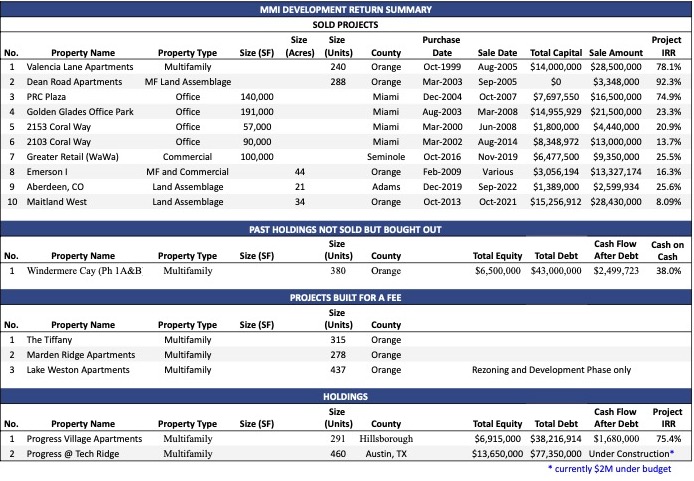

MMI Track Record

The Fund has relied on MMI Development because of its high ROI, effective process for project completion, and solid track record for success.

In addition to successfully completed projects, MMI has paved the way for enhancing development as MMI was the first developer in Orange County to complete the following:

- In 2002, MMI negotiated and entered into a Capacity Enhancement Agreement (CEA) with Orange County Public Schools. This agreement allowed rezoning of a group of parcels of land from Agriculture to Multifamily. CEAs were required by Orange County government as part of their implementation of school capacity requirement under the Martinez Doctrine.

- Gained 100% approval for deferral of impact fees over a three-year period from the date of last Certificate of Occupancy, thereby significantly decreasing the initial development budget on new construction.

- Gained vested rights against school concurrency. School concurrency was adopted statewide in 2008 and implemented in Orange County, FL in October 2008. School concurrency essentially states that a property cannot be rezoned to multifamily and/or get a building permit unless public schools serving the property have capacity for new students.

Past Projects

Progress @ Tech Ridge

Austin, Texas

- 460 unit community in the Tech Ridge submarket

- Build & Hold strategy

- Total project cost is around $94M

- Currently under construction, nearing completion

Progress Village Apartments

Tampa, Florida

Progress Village Apartments is a 291 unit multifamily property in Tampa, Fl. The project was completed in Q4 of 2020.

- 291-unit Class A apartment project

- MMI served as the project developer and construction manager and currently serves as the Asset Manager

- Total project cost was $48,000,000 ($1M under budget)

- Project level IRR is currently at 75.4%

The Tiffany at Maitland West

Maitland, Florida

The Tiffany at Maitland West is a 315 unit multifamily property in Maitland, Fl. The project was completed by MMI Development and later sold.

- 315-unit Class A apartment project

- MMI served as the project developer and construction manager

- Total project cost was $59,000,000

Lake Weston Apartments

Eatonville, Florida

Lake Weston Apartments is a 437 unit multifamily project located in Eatonville, a suburb of Orlando, FL.

- MMI was contracted by Federal Capital Partners.

- MMI supplied the plans for its proprietary multifamily product for the project

- MMI also oversaw all aspects of site planning, re-zoning, final permitting, engineering and architectural governance, budget preparation and selection of Walker & Co as GC – All successfully completed

Douglas Centre

Coral Gables, Florida

- 197,000 square foot, multi-tenant office building

- 197,000 square foot, multi-tenant office building

- MMI served as the development partner

- over 100,000 square feet of office leasing and tenant improvements

- Total capital Improvements exceeded $10,000,000 which increased value to $59,000,000 from original purchase price of $20,000,000.

Marden Road Interchange

Apopka, Florida

- Private, Public, Partnership (PPP) between MMI, City of Apopka and the Central Florida Expressway

- “On and Off” ramp from Maitland Boulevard (State Road 414) onto Marden Road

- This interchange is the first of its kind in Central Florida

- MMI served as the project developer and completed the project two months ahead of schedule and 7.3% under budget

- Total project cost was $8,000,000

Marden Ridge Apartments

Apopka, Florida

- Closest multifamily project to Florida Hospital Apopka

- MMI served as the project developer and construction manager

- Total project cost was $38,000,000 and was finished on schedule and within budget

- Lease up averages 15 units per month

Windermere Cay Apartments

Winter Garden, Florida

- 380-unit Class A apartment complex

- Phase 1A (272 units)

- Phase 1B (108 units)

- Adjacent to Walt Disney World

Wawa (Summit Plaza & Greater Mall)

Casselberry, Florida

- Covered land play

- Purchased a portfolio of 3 office buildings, renovated 2 buildings, and rearranged tenants into those 2 buildings to allow for redevelopment of the 3rd into a Wawa.

Dean Road Apartments (now Regent Park condos)

Orlando, Florida

- 288-unit, garden style, Class A apartments

- MMI assembled five contiguous parcels, consisting of 18 acres. The property was then rezoned for multifamily development.

2103 Coral Way

Miami, Florida

- Eight-story, 80,000 square-foot office building

- At the time of acquisition, this fractured office condominium building was 40% leased.

- MMI purchased the remaining units, collapsed the condominium form of ownership, stabilized the asset to 90% and sold the project in the summer of 2014.

Valencia Lane Apartments

Orlando, Florida

- 240-unit, garden style, multifamily community

- MMI was responsible for the land acquisition, rezoning, entitlement acquisitions, and construction management for this project.

Golden Glades Office Park

Miami Gardens, Florida

- 191,000 square-foot office park

- Eight low- and mid-rise office buildings

- At the time of acquisition, the property was 77% leased. Under MMI’s management, the property achieved 97% occupancy in nine months.

2153 Coral Way

Miami, Florida

- 32,000 square-foot office building

- After acquisition, MMI successfully extended and renewed the existing single tenant lease.

Shoppes at Ives Dairy Road

Miami, Florida

- 26,000 square-foot, neighborhood shopping center

- National tenants include Starbucks®, Chili’s Foot Locker®, RadioShack GameStop®, Subway®, and Wireless Toyz